Saving and investing your money wisely is essential, but did you know there’s a way to grow your wealth without paying tax on the gains? That’s where an ISA (Individual Savings Account) comes in. If you’re living in the UK, understanding ISAs can help you make the most of your savings. In this guide, we’ll break down everything you need to know about ISAs, from the different types to allowances, penalties, benefits, and potential downsides.

![Money in piggybank.png 1200x627 q90 crop center subsampling 2 upscale[1]](https://aleks1.com/wp-content/uploads/2025/02/money-in-piggybank.png__1200x627_q90_crop-center_subsampling-2_upscale1-1024x535.png)

What is an ISA?

An ISA (Individual Savings Account) is a special type of savings or investment account that allows you to grow your money tax-free. Unlike regular savings accounts where interest earned might be subject to tax, ISAs protect your savings from income tax and capital gains tax.

Why You Need an ISA

Tax-Free Growth: One of the biggest advantages of an ISA is that any interest, dividends, or capital gains you earn are completely tax-free.

Higher Returns Compared to Standard Savings Accounts: Many ISAs offer better interest rates than traditional savings accounts, helping your money grow faster.

Flexible Savings Options: With various types of ISAs available, you can choose one that fits your needs, whether it’s saving for a house deposit, investing for the future, or keeping emergency cash.

Government Incentives: Certain ISAs, like the Lifetime ISA, offer bonuses to boost your savings.

Why You Might Not Need an ISA

| ✅ Pros | ❌ Cons |

|---|---|

| Tax-Free Growth: No income tax or capital gains tax on savings and investments. | Investment Risk: Stocks and Shares ISAs can decrease in value. |

| Government Bonuses: Some ISAs, like Lifetime ISAs, offer extra contributions. | Lower Interest Rates: Some Cash ISAs offer lower rates than standard savings accounts. |

| Flexible Options: Cash, Stocks, Lifetime, and other types available. | Withdrawal Restrictions: Some ISAs have penalties for early withdrawals. |

| Long-Term Wealth Growth: Great for building wealth over time. | Annual Limits: Maximum £20,000 per year, which may not be enough for high-net-worth individuals. |

| Protection from Tax Changes: ISAs are a secure way to shelter savings from future tax hikes. | Fees May Apply: Stocks and Shares ISAs can have management and trading fees. |

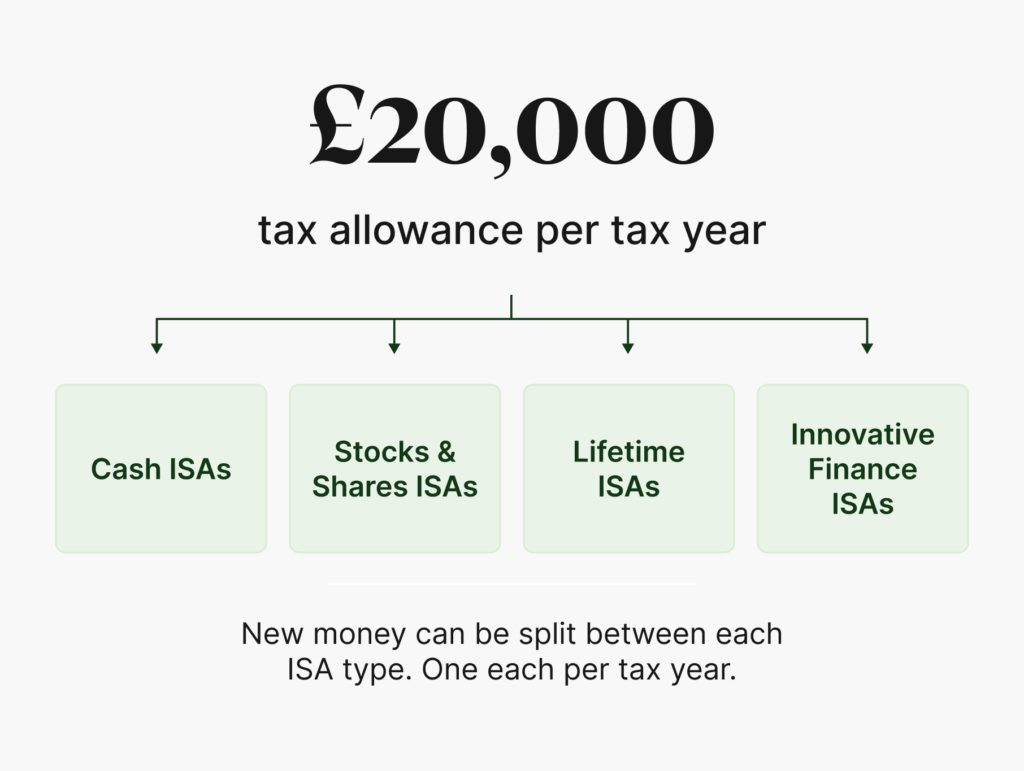

Types of ISAs in the UK

There are 5 main types of ISAs available in the UK in 2025:

Cash ISA

✅ What it is:

- A tax-free savings account that earns interest.

✅ Best for:

- People who want low risk savings.

- Anyone who wants quick access to their money.

- Those who prefer steady and safe growth over time.

❌ Not ideal for:

- People looking for high returns (interest rates are usually low).

- Those willing to invest for higher growth instead of just saving.

Stocks and Shares ISA

✅ What it is:

- A tax-free investment account where your money is put into stocks, bonds, or funds.

✅ Best for:

- People who want higher returns over time.

- Those comfortable with risk (investments can go up and down).

- Long-term savers (5+ years) looking to grow wealth.

❌ Not ideal for:

- Anyone who needs their money soon (markets fluctuate).

- People who don’t like risk (you could lose money).

Lifetime ISA (LISA)

✅ What it is:

- A tax-free account to buy your first home or save for retirement, with a 25% government bonus on what you save.

✅ Best for:

- First-time home buyers (under 40) saving for a deposit.

- People saving for retirement (you can withdraw at 60).

❌ Not ideal for:

- Anyone over 40 (you can’t open a new LISA).

- People who might need the money early (big penalties for early withdrawals).

Innovative Finance ISA

✅ What it is:

- A tax-free account for peer-to-peer lending (your money is lent to businesses or individuals for interest).

✅ Best for:

- People willing to take risks for higher returns.

- Investors comfortable with lending money to others.

❌ Not ideal for:

- Those who want guaranteed returns (borrowers could default).

- People who need instant access to their money.

Junior ISA

✅ What it is:

- A tax-free savings or investment account for children under 18, managed by parents/guardians.

✅ Best for:

- Parents who want to save/invest for their child’s future.

- Anyone who can lock money away until the child turns 18.

❌ Not ideal for:

- People who might need the money sooner (can’t withdraw before 18).

ISA Allowances and Limits

Each tax year (April 6 to April 5), the government sets an ISA allowance—the maximum amount you can put into ISAs tax-free. As of 2024, the allowance is £20,000 per year. You can split this across different ISAs but cannot exceed the total allowance.

For Lifetime ISAs, the limit is £4,000 per year, with the government adding a 25% bonus (up to £1,000). For Junior ISAs, the limit is £9,000 per year.

Charges and Fees in ISAs

While Cash ISAs usually don’t have fees, investment-based ISAs (Stocks and Shares, Innovative Finance) may have:

Management Fees: Charged by investment platforms or fund managers.

Trading Fees: If you buy and sell stocks within your ISA.

Exit Fees: Some providers charge a fee if you move your ISA to another provider.

Penalties for Withdrawing from an ISA

Not all ISAs let you withdraw money freely:

Cash ISAs: Typically have no penalties unless it’s a fixed-term ISA.

Stocks and Shares ISAs: No penalties, but withdrawing may lock in losses if your investments are down.

Lifetime ISA: A 25% penalty applies if you withdraw for anything other than buying a home or retirement.

Fixed-Term ISAs: May charge interest penalties if you withdraw before the term ends.

PROS & CONS

Tax-Free Growth: No income tax or capital gains tax on savings and investments. This means that any growth in your savings or investments will not be taxed, allowing your money to grow faster over time without the burden of tax deductions.

Variety of Choices: Cash ISA, Stocks and Shares ISA, Lifetime ISA, etc. You can choose from different types of ISAs depending on your financial goals, whether you’re looking for stable savings or higher growth potential with investments.

Flexible Contributions: Save or invest as much as you want within the annual limit. This flexibility allows you to contribute whenever it suits you, making it easier to manage your savings and investments according to your financial situation.

Government Bonuses: Lifetime ISAs offer a 25% bonus for homebuyers or retirement. The government will give you a 25% bonus on contributions to a Lifetime ISA, which can be used for purchasing your first home or saving for retirement.

Long-Term Wealth Growth: Compound interest and tax benefits enhance savings over time. The power of compound interest allows your savings to grow exponentially, while tax advantages help you keep more of your earnings.

Annual Contribution Limit: Restricted to £20,000 per year (2024 limit). This means you can only contribute up to £20,000 annually across all types of ISAs, which may be limiting if you wish to invest or save larger amounts.

Lower Interest Rates: Some Cash ISAs offer lower rates than high-interest savings accounts. Depending on the type of ISA, the interest rate may be lower than what you could earn from a standard savings account, particularly with Cash ISAs.

Investment Risk: Stocks and Shares ISAs can fluctuate and lose value. While there’s potential for higher returns, there’s also a risk of losing money due to market fluctuations, making Stocks and Shares ISAs more suitable for those who can accept some level of risk.

Withdrawal Restrictions: Some ISAs (Lifetime, Fixed-Term) have penalties for early withdrawal. If you need to access your money early, you may face penalties or miss out on the benefits of the ISA, especially with Lifetime and Fixed-Term ISAs.

Not Always Necessary: If you don’t pay tax on savings interest, an ISA may not provide extra benefits. For those with low or no taxable income, ISAs may not be worth the effort, as the tax benefits are less impactful.

How to Open an ISA

Opening an ISA is simple:

Choose the Right ISA: Decide whether you need a Cash ISA, Stocks and Shares ISA, or another type.

Find a Provider: Banks, building societies, and investment platforms offer ISAs.

Apply Online or In-Person: Most providers let you open an ISA within minutes.

Deposit Your Money: Start saving or investing up to your annual limit.

ISA vs. Other Saving and Investment Options

| Feature | ISA |

|---|---|

| Tax-Free Growth | Yes |

| Access to Money | Varies (depends on type) |

| Government Bonus | Lifetime ISA only |

| Investment Options | Cash, Stocks, Peer-to-Peer |

| Feature | Pension |

|---|---|

| Tax-Free Growth | Yes (until withdrawal) |

| Access to Money | Limited until retirement |

| Government Bonus | Yes (via tax relief) |

| Investment Options | Stocks, Bonds, Funds, Cash |

| Feature | Regular Savings Account |

|---|---|

| Tax-Free Growth | No |

| Access to Money | Anytime |

| Government Bonus | No |

| Investment Options | Cash Only |

Final Thoughts

An ISA is a fantastic way to save or invest tax-free, whether you want to grow cash savings, invest in stocks, or plan for a home. However, it’s not always the best option for everyone. Consider your financial goals, tax situation, and the type of savings you need before choosing the right ISA. Always consult with your financial adviser or expert to ensure it aligns with your personal circumstances.